Proven Investment Stategies

Investing in Values, Building Futures

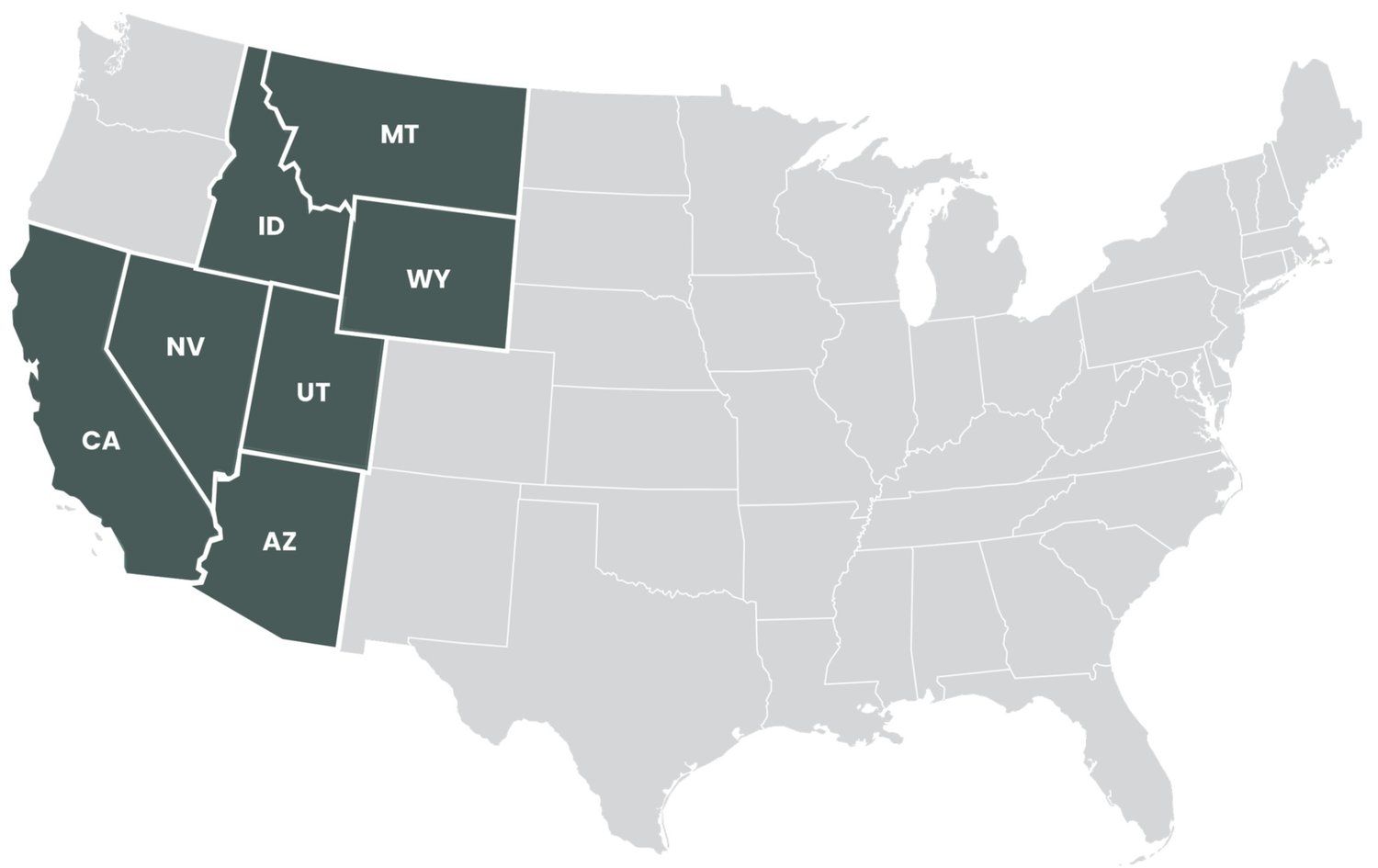

We target high-quality assets in key markets across the West Coast and Mountain States, where emerging technological and demographic trends create unique opportunities. Leveraging a flexible investment strategy and fully integrated operations, we focus on acquisitions ranging from $30 million to $150 million.

Where We Play

Target Markets

- California

- Nevada

- Idaho

- Utah

- Montana

- Wyoming

- Arizona

What We Buy

Asset Profiles

- 2000s and Newer

- 150+ Units

- Value-Add / Core / Core Plus

- Forward Sale / Pre Stabilized

- New Construction

How We Succeed

Capital Sources

Backed by private capital and institutional capital partners, we are well-equipped to execute in both the middle-market and institutional spaces, offering flexible and bespoke investment solutions.

Our Secret Sauce

Target Themes

- Opportunistic, off-market transactions through cultivated relationships

- Assets located near public transportation nodes, quality employment hubs, preferred schools, and high-street retail

- Attractive lifestyles to renter-centric demographics, especially the Millennial cohort

- Discount to replacement cost

- Metros with strong tailwinds such as limited supply, and drivers of solid wage and employment growth

- Class A and B+ (in A locations) light value-add assets with operational or renovation upside

- Rental supply & demand imbalances due to lack of affordable inventory and a growing population